THESE are Northern Ireland’s fugitives from ‘The Taxman’

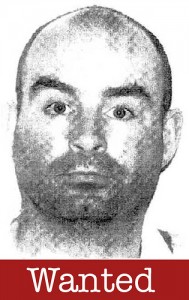

The PSNI are currently looking for them as they appeared on a list of the UK’s most-wanted tax evaders.

A warrant for one of them, Michael “Arthur” Fearon, was issued in Newry, County Down, for allegedly avoiding £2 million in cigarette duty.

The other is a County Galway man who is believed to be at large in Northern Ireland or the Irish Republic.

Rory Martin McGann, 43, is accused of an alleged VAT fraud of £900,000.

He was arrested in November 2008, but later fled.

It has emerged that out of 20 people named on a government list last year, only one has been tracked down.

HM Revenue and Customs (HMRC) published the names and photographs of people it said had cost taxpayers millions in lost revenue, but 19 remain at large.

HMRC said it had intelligence on a number of suspects and 10 more faces have now been added to its gallery.

It said last year’s appeal had helped provide intelligence on 15 of the alleged offenders, while one was arrested.

In May this year a man from south Belfast was among three tax cheats in Northern Ireland who have been named and shamed.

Painter James Joseph Farmer, from Stanfield Row in the Markets area of city, faces a penalty of over £100,000 for deliberately defaulting on almost a year and a half’s worth of tax.

Philip Thompson, of the Larne road haulage company Philip Thompson Transport, was penalised £25,361 for offences between April and October 2010.

Transport and storage firm Meighfreight Services Ltd. which formerly traded from Kellys Road in the Killeen area of Newry, faces a penalty of £30,778.

Every quarter, the HMRC will publish the name of tax cheats as part of its fight against tax evasion and non-compliance.

“Anyone who is thinking about avoiding their responsibilities should consider the consequences before they refuse to tell HMRC about their full tax liability,” Jennie Granger, Director General for Enforcement and Compliance, said.

“Cheating on tax is wrong and HMRC is dedicated to clamping down on the small minority of people who try to evade their responsibilities.

“Publishing these names encourages defaulters to make a full and prompt disclosure and cooperate with HMRC to avoid being named – all the named defaulters have exhausted the appeals process.”

One Response to REVEALED: NI’S MOST WANTED TAX DODGERS